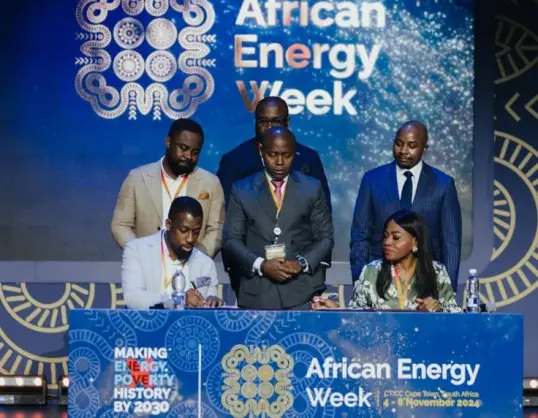

African Export-Import Bank (Afreximbank) (www.Afreximbank.com) on November 5 in Cape Town, South Africa, signed an agreement for a US$ 100-million Revolving Trade Finance Facility in favour of oil trader JE Energy Limited to support its contract implementation in the Republic of Guyana.

Under the terms of the agreement signed on the sidelines of the African Energy Week, JE Energy Limited, which has been awarded contracts to lift and market crude oil from Guyana, shall utilize the two-year facility to finance the purchase and sale of crude oil from Guyana’s Ministry of Natural Resources for onward sale to reputable international offtakers.

Issued in the context of Afreximbank’s drive to grow business opportunities in its member countries in the CARICOM region, the facility is expected to help ensure that Guyana is able to trade internationally and to benefit from its natural resources while earning much needed foreign currency.

Signing the agreement on behalf of Afreximbank was Mrs. Helen Brume, Director&Global Head of Project&Asset Based Finance, while Mr. Joseph Ilebode, Group Managing Director, JE Energy Limited, signed for his company.

Ms. Gwen Mwaba – Managing Director, Trade Finance&Correspondent Banking at Afreximbank commented: “Afreximbank is thrilled to support JE energy in their recent contract with the Republic of Guyana to facilitate the export of the country’s crude oil. This partnership not only highlights our commitment to fostering sustainable energy solutions in Africa and beyond but also strengthens regional trade ties. We believe that supporting innovative companies like JE Energy is crucial for unlocking economic potential and driving growth in the energy sector. Together we can contribute to a prosperous future for Guyana and the wider region.”

Mr. Joseph Ilebode, Group Managing Director at JE Energy commented: “We are very grateful to Afreximbank for the facility granted to JE Energy Ltd. It is a clear demonstration of Afreximbank’s willingness to support capable partners in driving energy solutions and unlocking the potential in the sector. We strongly believe this will go a long way to support JE Energy’s plan not only in Guyana but across the African continent.”

Guyana has emerged a significant contributor to growth in the global supply of crude oil since starting production in 2019, with its crude oil production reaching 645,000 barrels per day in early 2024 and crude oil production becoming the largest contributor to its economic growth.

Organised by the African Energy Chamber, the four-day African Energy Week, brings together African energy leaders, global investors and executives from the public and private sectors for dialogue on the future of the African energy industry. Running from 4 to 8 November, the event is featuring an interactive conference, exhibition and networking events, panel discussions, investor forums, industry summits and one-on-one meeting opportunities.

Distributed by APO Group on behalf of Afreximbank.

Media Contact:

Mr Vincent Musumba

Manager, Communications and Events (Media Relations)

Email: press@afreximbank.com

Follow us on:

X: https://apo-opa.co/41c2vpa

Facebook: https://apo-opa.co/3ZcbSmh

LinkedIn: https://apo-opa.co/41fRd3c

Instagram: https://apo-opa.co/4186JhD

About Afreximbank:

African Export-Import Bank (Afreximbank) is a Pan-African multilateral financial institution mandated to finance and promote intra-and extra-African trade. For 30 years, the Bank has been deploying innovative structures to deliver financing solutions that support the transformation of the structure of Africa’s trade, accelerating industrialization and intra-regional trade, thereby boosting economic expansion in Africa. A stalwart supporter of the African Continental Free Trade Agreement (AfCFTA), Afreximbank has launched a Pan-African Payment and Settlement System (PAPSS) that was adopted by the African Union (AU) as the payment and settlement platform to underpin the implementation of the AfCFTA. Working with the AfCFTA Secretariat and the AU, the Bank is setting up a US$10 billion Adjustment Fund to support countries effectively participating in the AfCFTA. At the end of December 2023, Afreximbank’s total assets and guarantees stood at over US$37.3 billion, and its shareholder funds amounted to US$6.1 billion. Afreximbank has investment grade ratings assigned by GCR (international scale) (A), Moody’s (Baa1), Japan Credit Rating Agency (JCR) (A-) and Fitch (BBB). Afreximbank has evolved into a group entity comprising the Bank, its impact fund subsidiary called the Fund for Export Development Africa (FEDA), and its insurance management subsidiary, AfrexInsure (together, “the Group”). The Bank is headquartered in Cairo, Egypt.

For more information, visit: www.Afreximbank.com